what is retention bonus: explained and how it works

Let's get right to it. A retention bonus is a financial incentive aimed squarely at one goal: convincing a key employee to stick around through a make-or-break period for the company. Think of it as a strategic "stay bonus," a powerful tool designed to prevent critical talent from walking out the door when you can least afford it.

The Core Idea Behind a Retention Bonus

Unlike a performance bonus, which rewards past achievements, a retention bonus is all about the future. It's a one-time payment—or sometimes a series of payments—offered in exchange for a simple promise: the employee agrees to stay with the company for a specific, predetermined amount of time.

Picture this: your company is in the middle of a massive merger. The success of the whole operation hinges on your lead software architect staying on for the next 18 months to integrate the two technology platforms. A hefty retention bonus gives that architect a very compelling reason to see the project through, providing stability and protecting the company's investment during a shaky transition. It's a way for businesses to navigate turbulence without losing the very people who hold the map.

Why Retention Bonuses Are a Bigger Deal Than Ever

In today's job market, top talent has options—lots of them. Companies are realizing that a good salary and standard benefits aren't always enough to keep their best people from getting poached. That's where strategic bonuses come into play.

This isn't just a niche tactic anymore. Recent data shows just how mainstream retention bonuses have become. A whopping 66% of organizations globally now use them, a massive jump from just a few years ago. This is part of a much larger trend, with nearly all companies—98% to be exact—now using some kind of bonus program to attract and keep their staff. You can discover more insights on bonus program trends from WorldatWork in their latest report.

This surge in popularity really just confirms a simple business truth: the cost of losing an indispensable employee is almost always higher than the cost of convincing them to stay.

Retention Bonus at a Glance

To boil it all down, let's look at the basic building blocks of a retention bonus. Understanding these components is the first step for any employer thinking about offering one or any employee who has just been offered a deal.

| Component | Description |

|---|---|

| Purpose | To secure an employee's commitment for a specific future period. |

| Recipient | A key employee whose departure would create significant disruption. |

| Trigger Events | Often used during mergers, critical projects, or restructuring. |

| Payment Structure | Can be a lump sum, periodic installments, or tied to milestones. |

| Agreement | Formalized in a written contract outlining all terms and conditions. |

At its heart, a retention bonus is a straightforward agreement. It’s a clear, contractual way for a company to say, "We need you here for what's coming next, and we're willing to invest to make sure that happens."

When to Strategically Use Retention Bonuses

A retention bonus isn't just a golden handshake; think of it as a precision tool for navigating those nail-biting, high-stakes moments every business faces. The idea is simple—pay a key person to stick around—but knowing when to use it is what separates a smart investment from a costly mistake. Companies pull this lever when the risk of a star player walking out the door becomes a direct threat to the company’s stability or growth plans.

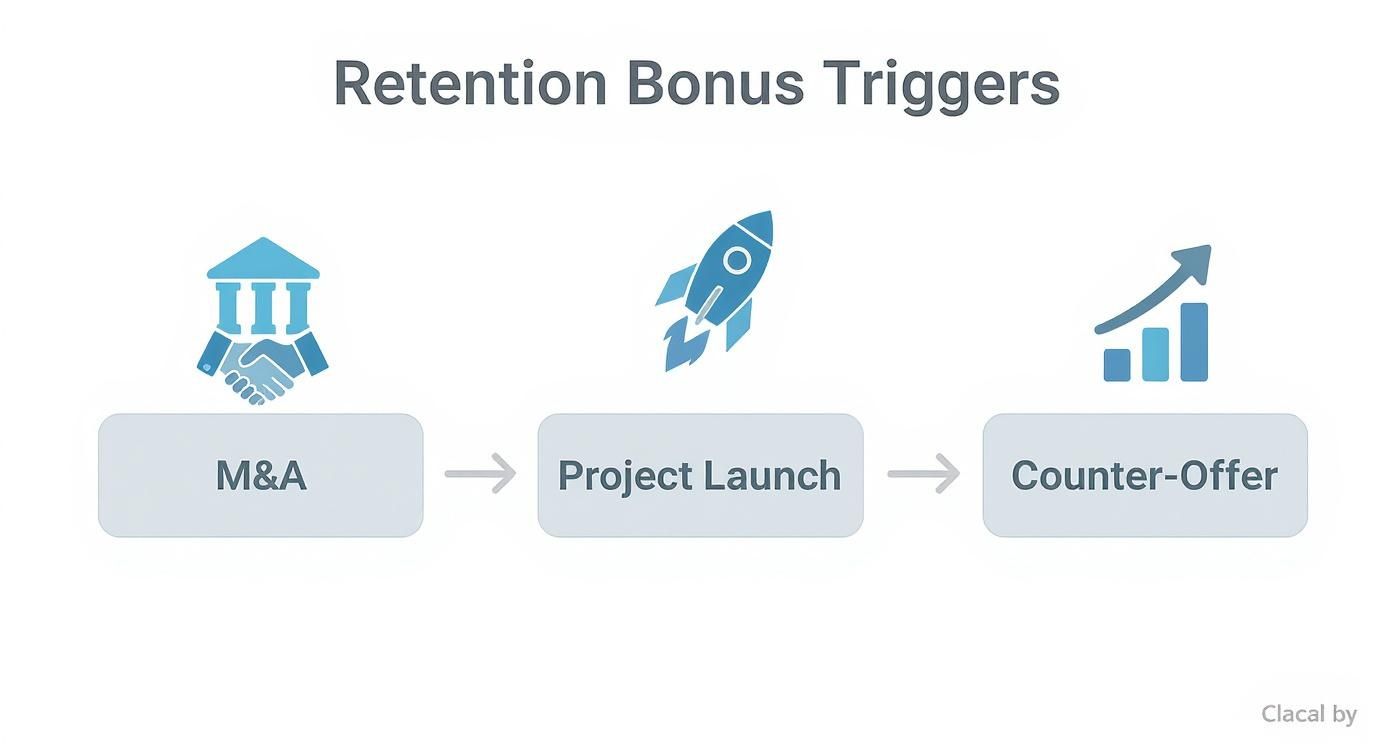

The most classic scenario? A merger or acquisition (M&A). This is a time of peak uncertainty. Talented employees, worried about layoffs or culture clashes, start polishing their resumes. For the company doing the buying, losing key people from the firm they just bought can instantly tank the value of the entire deal.

Let's say your tech startup is being acquired. The buyer’s success hinges on your head of product staying for the next 18 months to oversee the technology integration and merge the product teams. If she leaves, a massive knowledge vacuum opens up, and the whole integration could fall apart. This is a textbook case for a retention bonus. It’s the glue that holds the deal’s value together.

Beyond Mergers and Acquisitions

While M&A is the most common trigger, other critical moments also call for a well-timed retention bonus. The common thread in all these situations is that the cost and chaos of losing one specific person far outweighs the price of the bonus itself.

Here are a few other prime examples:

- During a Major Product Launch: Got a lead engineer who is absolutely essential to shipping your flagship product? A bonus can be the very thing that keeps them focused through the final, grueling push to launch day.

- Navigating a Big Restructure: When a company is downsizing or pivoting its business model, keeping steady leadership in place is vital for managing team morale and guiding everyone through the bumpy transition.

- Seeing a Critical Project to Completion: The project manager overseeing a complex, multi-year initiative holds a ton of institutional knowledge. A bonus can lock in their expertise until the project is successfully across the finish line.

The Art of the Counter-Offer

Retention bonuses are also a powerful weapon in the counter-offer arsenal. When a top performer gets a tempting offer from a competitor, a simple salary match often isn't enough to keep them. Psychologically, they already have one foot out the door.

A retention bonus sweetens the pot in a big way. It sends a strong message: "We don't just value your past work; we are actively investing in your future here." This financial commitment can be the tipping point that makes staying feel more compelling than the risk of starting somewhere new. Of course, this has to be paired with real conversations about their career path and fixing whatever made them look for a new job in the first place. You can see how these incentives stack up against other models in our guide on what is performance-based compensation.

The strategic power of a retention bonus lies in its timing. It’s not a reward for past work but a forward-looking investment to secure a specific, critical outcome for the business.

This targeted approach is especially common during M&A. In fact, data shows that 86% of acquiring companies use cash retention bonuses for senior leaders, and 80% offer them to other salaried employees to make sure the transition goes smoothly. These numbers show just how critical this tool is for keeping things on track when the stakes are highest. You can learn more about how companies are enhancing their M&A retention strategies with WTW.

Ultimately, the decision to offer a retention bonus comes down to a clear-eyed risk assessment. The question every leader needs to ask is simple: what’s the real cost if this person leaves right now? When the answer is "disastrous," the bonus becomes an essential strategic move.

How to Structure and Calculate a Retention Bonus

Figuring out a retention bonus is more art than science. It's not just about dangling a carrot; it's about crafting an offer that feels right for both the company and the person you're trying to keep. The way you structure the bonus—how it’s calculated, when it’s paid out, and what strings are attached—is just as crucial as the final number. A poorly designed bonus can backfire, either failing to motivate or, even worse, encouraging an employee to grab the cash and run.

The first piece of the puzzle is the retention period. How long do you need this person to stay? Be specific. This isn't an arbitrary timeline; it should be directly linked to a business goal. Maybe you need them for the 18 months it'll take to see a merger through, or the 12 months required to get a new product off the ground and stable.

Common Payment Structures

Once you have your timeline, you need to decide how the money will actually be paid. There's no one-size-fits-all answer here. The best approach depends entirely on the situation and what you're hoping to accomplish.

Here are the three most common ways to do it:

- Lump-Sum Payment: This is the classic approach. The employee gets the entire bonus in one big check after they’ve completed the full retention period. It's a powerful, all-or-nothing incentive that really motivates them to stick it out until the very end.

- Periodic Installments: With this method, you break the bonus into smaller, regular chunks—say, quarterly or semi-annually—paid throughout the retention period. This can feel less like "golden handcuffs" and more like a steady reward for their ongoing commitment.

- Milestone-Based Payouts: Here, payments are tied to hitting specific, measurable goals. For instance, an engineer might get 50% of their bonus when a key product feature ships and the other 50% after the full 12-month period is up. It connects the bonus directly to performance.

The infographic below really nails down the common business triggers that get these conversations started in the first place.

As you can see, it's often major events like mergers, big project launches, or trying to fend off a poacher that spark the need for a solid retention plan.

How to Calculate the Bonus Amount

There isn't a magic formula for the bonus amount, but the go-to method is to base it on a percentage of the employee's annual base salary. What that percentage looks like really depends on the employee's role, their seniority, and just how badly you need them.

Here’s a general rule of thumb:

- Key Staff & Individual Contributors: For critical specialists, senior engineers, or project leads, a bonus between 10% to 25% of their annual salary is pretty standard.

- Directors & Senior Management: For leaders whose presence is vital for team stability and strategy, you're often looking at a range of 25% to 50%.

- C-Suite Executives: For the top brass, bonuses can easily climb past 50% or even 100% of base salary, reflecting their massive impact on the company's trajectory during a pivotal time.

Sometimes, a bonus might involve company shares instead of just cash. If you’re curious about how that works as a long-term incentive, check out our guide on what is equity compensation to see how it aligns employee and company goals.

The Importance of a Formal Agreement

Whatever you decide on, get it in writing. A formal retention bonus agreement is non-negotiable. This simple document protects everyone by clearly laying out the terms and preventing any "he said, she said" arguments down the road. It transforms a handshake deal into a binding commitment.

Sample Agreement Language

"In consideration of your continued employment with [Company Name] through [End Date of Retention Period], you will be eligible to receive a one-time retention bonus of [$Amount]. This bonus will be paid to you in a single lump sum, less applicable withholdings, within 30 days following the retention end date, provided you remain an active, full-time employee in good standing on that date."

A simple clause like this is the heart of the agreement. A full contract, of course, would also spell out what happens if the employee quits, gets fired for cause, or is laid off. Covering all the bases is what makes for a transparent and effective offer.

Weighing The Pros And Cons For Your Business

A retention bonus can feel like a silver bullet—a quick, financial fix to keep a key employee from walking out the door. But it's not a magic wand, and pulling that trigger without thinking it through can sometimes cause more problems than it solves.

Before you even think about drafting an offer, you need to understand the full picture. A retention bonus creates a new dynamic, and it comes with a distinct set of trade-offs for both you and the employee you’re trying to keep.

The View From The Company's Side

For any business, the big win here is stability. Let's say you're in the middle of a messy merger or pushing a critical project over the finish line. A retention bonus can feel like an anchor in a storm. It keeps an expert's institutional knowledge and leadership right where you need it, preventing a sudden departure from derailing everything.

It also sends a clear message. Offering a hefty bonus tells a top performer, "We see you, and you are absolutely critical to our future." That kind of direct validation can go a lot further than a simple "great job" in a performance review.

But these perks come with some serious risks. The most obvious is the hit to your budget. Retention bonuses are expensive, and you have to be damn sure the employee's contribution justifies that line item. There’s no guarantee you’ll see a positive return on that investment.

Then there's the cultural fallout. If you start throwing cash at every flight risk, you can accidentally create a transactional culture where loyalty is simply for sale. Other team members who weren't offered a bonus might feel slighted, leading to resentment that can poison team morale.

The biggest gamble is what I call the "bonus cliff." It's a classic story: an employee sticks around just long enough to cash the check, and then their two-week notice lands on your desk the following Monday. The bonus bought you their time, but it didn't buy their heart.

The View From The Employee's Side

For the employee, the appeal is obvious: a nice big check. It's a tangible reward for their hard work and a clear sign that the company values them enough to put its money where its mouth is. That can be a huge motivator.

But it's not all sunshine and dollar signs. A retention bonus can quickly start to feel like a pair of "golden handcuffs." The employee might feel stuck in a job they were otherwise ready to leave, just because the money is too good to walk away from. They're essentially trading their professional freedom for a payout, and that can lead straight to burnout.

It can also create some really awkward moments at the water cooler. When word gets out—and it almost always does—colleagues who didn't get an offer can feel undervalued, creating a tense and competitive environment. And let's not forget the pressure—the employee now has to constantly prove they were worth the investment, which can be incredibly stressful.

Retention Bonuses A Two-Sided Coin

To really get a handle on this, it helps to see the trade-offs laid out side-by-side. What looks like a clear win from one perspective can reveal some hidden downsides from another.

| Perspective | Pros (Advantages) | Cons (Disadvantages) |

|---|---|---|

| The Company | • Secures Critical Talent: Ensures key employees stay through vital periods like mergers or project completions. • Maintains Continuity: Prevents knowledge gaps and operational disruptions. • Signals Employee Value: Demonstrates a strong commitment to top performers. |

• High Financial Cost: A direct and often significant expense on the balance sheet. • Risk of "Bonus Cliff": Employees may leave immediately after the payout. • Creates a Transactional Culture: Can erode intrinsic loyalty and cause team resentment. |

| The Employee | • Significant Financial Gain: Provides a substantial, one-time cash payment. • Professional Recognition: A clear signal of being a highly valued team member. • Career Security: Offers stability during times of organizational uncertainty. |

• "Golden Handcuffs": Can feel trapped in a job they are ready to leave. • Potential Peer Resentment: May create tension with colleagues not offered a bonus. • Increased Performance Pressure: The expectation to deliver and justify the investment can be stressful. |

At the end of the day, a retention bonus is a surgical tool, not a cure-all. It's a short-term fix for a very specific problem and can work wonders when used correctly. But never mistake it for a substitute for the things that build real, lasting loyalty: a positive work culture, fair compensation, and opportunities for people to actually grow their careers.

Getting the Fine Print Right: Taxes and Legal Agreements

It’s easy to get excited about a big bonus number, but the devil is truly in the details. Skipping over the financial and legal fine print of a retention bonus can create a world of headaches for everyone involved. A handshake deal is a recipe for disaster; these offers need to be buttoned up with a formal, written agreement to have any real teeth.

Before you offer or accept a retention bonus, you have to get your head around the tax implications and what goes into a solid legal contract.

First things first: the IRS doesn't see a retention bonus as a gift. It's supplemental income, plain and simple. That means it’s taxed just like your regular salary, and you'll see deductions for federal, state, and local taxes, plus those for Social Security and Medicare (FICA).

This is a crucial point because it drastically affects the actual cash you'll take home. A $20,000 bonus on paper is going to look a lot smaller after taxes. Understanding this from the get-go prevents that sinking feeling when the deposit hits your account.

How Taxes Get Taken Out

Since this is extra pay, employers typically use one of two methods to withhold federal income tax. The choice can impact how much an employee pockets right away.

- The Percentage Method: This is the no-fuss approach. The employer simply withholds a flat 22% from the bonus for federal taxes. It's clean, predictable, and the most common way to handle one-off payments like these.

- The Aggregate Method: With this method, the employer lumps the bonus in with the employee's regular paycheck for that period. They then calculate the withholding on the total amount based on the employee's W-4. For higher earners, this can sometimes push them into a higher tax bracket for that paycheck, resulting in a bigger initial withholding.

Let's break it down. Imagine you're getting a $20,000 bonus. If your company uses the flat 22% method, that’s $4,400 gone right off the top for federal taxes. Then, you've got FICA taxes at 7.65%, which takes out another $1,530. Suddenly, your $20,000 bonus is now $14,070—and that’s before your state and local taxes have even had their turn.

The Retention Agreement: Your Single Source of Truth

Taxes are just one piece of the puzzle. The entire deal must be laid out in a crystal-clear, written retention agreement. This legal document protects both the company and the employee by spelling out every term of the arrangement, leaving no room for "he said, she said" down the road.

A well-constructed agreement should always cover a few essential bases:

- The Retention Period: It needs to explicitly state the commitment timeline with a clear start and end date. For instance, "from June 1, 2024, to December 1, 2025."

- Bonus Amount and Payout Schedule: This part details the full bonus amount and precisely when it gets paid. Will it be a lump sum at the end? Paid in chunks throughout the year? Tied to project milestones?

- Conditions of Employment: The agreement should make it clear that the employee needs to remain in good standing to receive the payout.

- Clawback Provisions: This is perhaps the most critical part of the entire document. It defines what happens if the employee decides to leave before the retention period is over. Usually, this means they have to repay the entire bonus, or at least a prorated portion of it.

A well-drafted retention agreement isn't just a formality; it's a strategic tool. It ensures the bonus achieves its intended purpose—securing commitment—while providing a clear, enforceable framework if things don't go as planned.

Exploring Alternatives to Cash Bonuses

While a big check is a powerful way to get someone’s attention, it’s not the only tool in the retention toolbox. In fact, many companies are discovering that a more rounded approach—one that mixes financial rewards with things that genuinely matter to people—builds a much stickier, more sustainable sense of loyalty.

These alternatives get to the heart of why great employees stick around for the long haul: they want to grow, they want to feel like an owner, and they want a healthy work-life balance.

This isn't just about being a "nice" place to work; it's smart business. Replacing a key team member can cost a company anywhere from three to six times that employee's salary. Once you factor in recruiting fees, training time, and the productivity hit, you can see why creative retention strategies are such a good investment. You can discover more about the financial impact of turnover in this report.

Thinking beyond cash isn't a "nice-to-have"—it's a strategic must.

Equity and Ownership Stakes

Giving an employee a piece of the pie is one of the most compelling alternatives to a cash bonus. Offering equity through stock options or restricted stock units (RSUs) changes the entire dynamic. Unlike a one-time payment, it ties an employee’s financial future directly to the company's long-term success.

Suddenly, they’re not just an employee; they're an owner. Their mindset shifts from just doing a job to actively finding ways to build value and help the company win.

- Vesting Schedules: Equity almost always comes with a vesting schedule, which means an employee earns their ownership stake over a set period, like four years. This naturally encourages them to stick around much more effectively than a bonus tied to a single year.

- Long-Term Wealth Creation: A cash bonus gets spent. Equity, on the other hand, has the potential to grow significantly over time, offering a much bigger financial reward for their loyalty and hard work.

Investing in Professional Growth and Flexibility

Sometimes, the best reasons to stay have nothing to do with money. Ambitious, talented people are often driven by the chance to learn new things, expand their skills, and tackle bigger challenges.

A retention bonus can feel like a transactional patch on a deeper problem. Sustainable loyalty is built by creating a work environment that people genuinely don't want to leave, where they feel valued and see a clear path forward for their careers.

Here are a few high-impact, non-cash incentives to consider:

- Professional Development Budgets: Earmark a generous budget for an employee to attend conferences, get a new certification, or even pursue an advanced degree. It's a direct investment in their growth.

- Enhanced Job Responsibilities: Give a key employee a bigger role with more autonomy, strategic input, or leadership duties. It’s a powerful signal that you trust them and see them as a critical part of the future.

- Flexible Work Policies: Offer options like a four-day work week, remote work, or truly flexible hours. For many people, this kind of respect for their life outside of work is worth more than a bonus.

At the end of the day, these alternatives aren't just different ways to pay someone; they're different ways to show you value them. While cash solves a short-term need, strategies like equity and professional growth build a rock-solid foundation for loyalty that lasts. To see how these incentives fit into the bigger picture, check out our guide on what is variable compensation.

Your Questions About Retention Bonuses, Answered

Even when you know the basics, the real world has a way of throwing curveballs. Let's tackle some of the most common and practical questions that pop up for both companies and employees when a retention bonus is on the table.

Think of this as a field guide for those tricky, in-the-moment situations you're likely to face.

Can an Employee Actually Negotiate a Retention Bonus?

You bet they can. While the company almost always kicks things off with an initial offer, it’s rarely a take-it-or-leave-it situation. As an employee, you have leverage. You can build a compelling case by pointing to your current market value, outlining your critical contributions, or even mentioning other opportunities you're weighing.

For employers, this is where flexibility pays off. Sometimes, just showing you're willing to talk about the bonus amount, the length of the retention period, or the payout schedule can make all the difference. It can be the one thing that convinces a key player to stay. The best negotiations are always professional, with both sides clearly explaining the "why" behind their requests.

What Happens if Someone Leaves Early?

This is the big one. If an employee quits before the retention period is up, they will absolutely forfeit any part of the bonus they haven't received yet. But the real question is what happens to money that's already been paid out.

This is precisely why a formal, written agreement is non-negotiable.

Every solid retention agreement needs a "clawback clause." This is the legal language that requires an employee to pay back all or a prorated portion of the bonus if they resign or are fired for cause before fulfilling their end of the deal.

A good agreement will spell out the consequences for every scenario—voluntary resignation, termination for cause, even a layoff—to prevent any messy legal disputes down the road.

Are Retention Bonuses Just for the C-Suite?

Not these days. That's a common misconception. While they've long been a staple for keeping senior leadership locked in during uncertain times, retention bonuses are now used much more broadly. Today, they're offered to any employee whose exit would cause a significant headache or business risk.

This has opened the door to a whole range of roles:

- Software engineers who are the only ones who truly understand a critical piece of legacy code.

- Top-performing salespeople who hold the relationships with your biggest accounts.

- Project managers steering a complex, multi-year initiative that can't afford a leadership change.

Ultimately, it’s not about the job title; it's about the impact. A retention bonus is a strategic tool for protecting a company’s most valuable assets: the people who get the work done.

At SalaryGuide, we believe that understanding your full compensation potential is the first step toward career growth. Our platform provides the real-time data and career intelligence marketing professionals need to benchmark their value, find the right opportunities, and earn what they deserve. Explore SalaryGuide today to take control of your career journey.