How to Assess Fair Market Value Like a Pro

At its heart, assessing fair market value is all about finding a single, crucial number: the price an asset would fetch on the open market. This isn't just any transaction, though. It's a hypothetical one between a willing buyer and a willing seller, where both sides know all the relevant facts and neither is under any duress to make a deal.

It’s the equilibrium point, the price where supply and demand shake hands without any outside pressure messing things up.

What Fair Market Value Really Means

Before you start crunching numbers, you have to get your head around what fair market value (FMV) truly is. It's more than just a figure in a report; it's a concept built on an ideal, arm's-length transaction. Think of it as the most probable price, not an absolute guarantee.

For a deeper dive into the theory behind the practice, this essential guide to fair market value provides some fantastic context. This core principle is the foundation for any valuation you'll ever do, whether you're pricing a home, a business, or negotiating a salary.

Distinguishing FMV From Other Values

It's incredibly common to see FMV confused with other financial terms, but they all mean very different things. Getting them mixed up is a surefire way to end up with a shaky assessment and a weak negotiating position.

Let's clear up a few of the main culprits:

- Book Value: This is a pure accounting term. It’s simply an asset's original cost minus all the depreciation that's been recorded against it. For example, a five-year-old company laptop might have a book value of $0, but you could still sell it for a few hundred dollars—that's its FMV.

- Intrinsic Value: This one is far more subjective. It’s an attempt to measure an asset's "true" worth based on its future potential to generate cash. A tech startup might have very little revenue (and a low book value), but if investors see huge growth ahead, its intrinsic value—and therefore its FMV—could be massive.

- Replacement Cost: This is exactly what it sounds like: what would it cost to replace an item right now? It's a key number for insurance claims, but it rarely lines up with what a buyer would actually pay you for the used item you already have.

Fair market value is a snapshot of current market reality. It completely ignores sentimental attachment, what you originally paid for something, or what it would cost to build a new one from the ground up.

Why Context Is Everything in Valuation

The word "market" in fair market value is the most important part of the phrase. There's no such thing as a universal FMV for a role like a skilled marketing manager. That value shifts dramatically depending on the industry (tech vs. manufacturing), the company's size, and especially the geographic location.

A perfect real-world application of this is figuring out what is a competitive salary in a specific city and sector.

Ultimately, getting FMV right starts with a solid grasp of its definition and all its little nuances. That conceptual clarity is what elevates your work from a simple guess to a defensible, data-backed conclusion.

Sourcing and Vetting Your Market Data

Any fair market value assessment lives or dies by the quality of its data. This is where the real work begins. It’s tempting to just grab the first salary survey or public record you find, but that's a recipe for a flawed analysis. The real expertise lies in a healthy dose of skepticism—critically evaluating every data point to make sure it’s accurate, relevant, and current.

Think of yourself as a detective, not just a collector. Your job is to filter out the noise. A single misleading data point, like a property sold between family members at a steep discount, can completely throw off your averages and lead you down the wrong path.

Finding Quality Data Sources

The most reliable valuations never lean on a single source. You need to build a complete picture by pulling from several different places. This lets you cross-reference your findings and spot any outliers that just don't feel right.

Here are some of the most reliable places to start your search:

- For Compensation: I always start with reputable salary platforms and industry-specific surveys, often published by professional associations. Anonymized, self-reported data from trusted career communities can also add valuable context. To really dig in, our guide on how to determine salary ranges shows how these different sources fit together.

- For Real Estate: Stick to the gold standards: public records of recent sales, data from the Multiple Listing Service (MLS), and reports from established real estate analytics firms.

- For Business Assets: Your best bet is looking at industry M&A reports, public company financial statements (for finding comparable businesses), and specialized private transaction databases.

A Practical Checklist for Vetting Data

Once you’ve gathered your initial data, it’s time to put it under the microscope. This is the quality control step that separates a good analysis from a great one. You have to be ruthless about spotting and tossing out questionable data before it taints your results.

To make sure your market data is solid, it's worth exploring strategies on how to improve data quality from the very beginning.

Your goal isn't to find the most data, but the best data. A handful of highly relevant, verified data points is infinitely more valuable than a mountain of questionable information. It’s about precision, not volume.

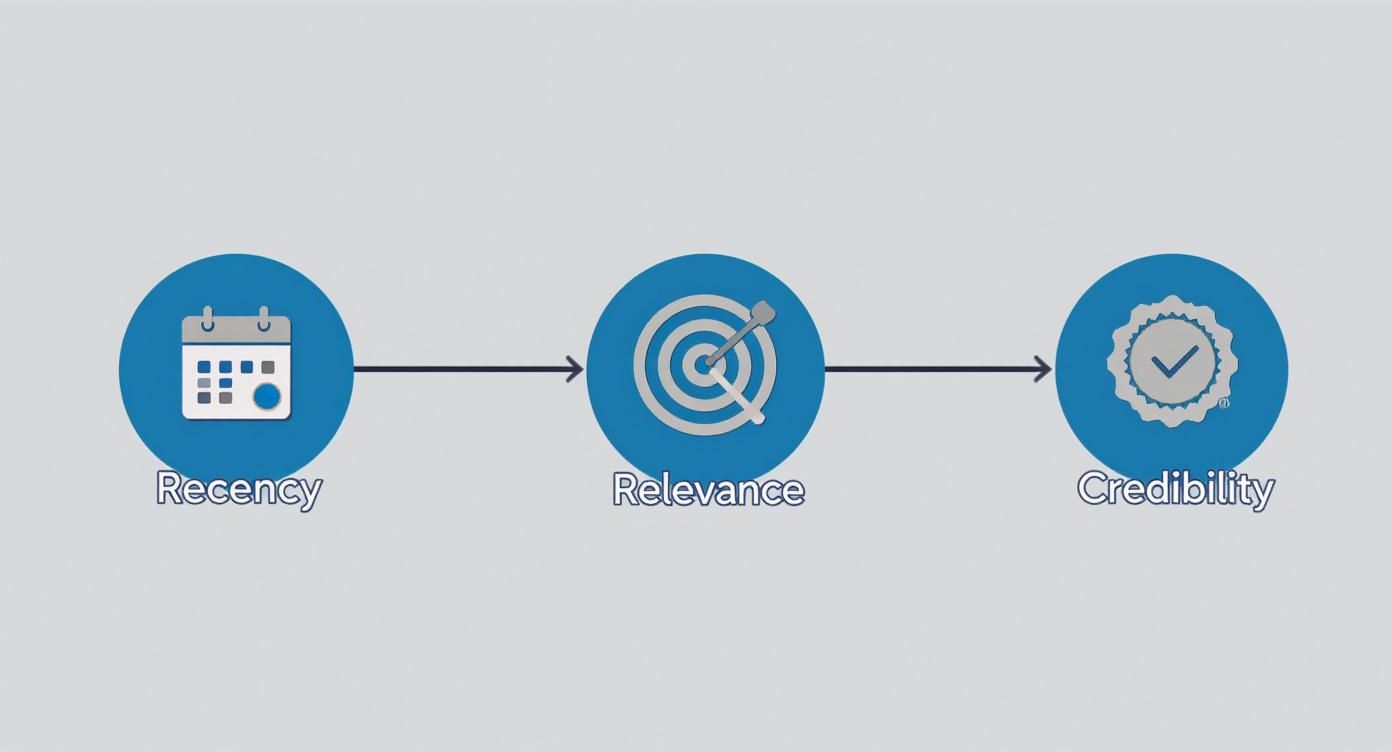

Before you let any piece of information into your analysis, run it through these three critical questions:

Is It Recent? Markets move fast. A salary survey from three years ago is practically ancient history. I generally aim for data that’s no more than 12-18 months old. If it’s a particularly volatile market, I try to get even closer to the present day.

Is It Relevant? This is huge. Does the data actually match what you're assessing? A "Project Manager" salary at a 50-person startup in Omaha has almost nothing in common with the same title at a 5,000-person tech firm in Silicon Valley. Be aggressive with your filters—industry, company size, location, and specific responsibilities all matter.

Is the Source Credible? Where did this data come from? Was it collected with a sound methodology, or is it just a random post on a forum? Always give more weight to official reports, government statistics, and platforms that are transparent about how they gather their information.

Looking at historical data is also incredibly useful, especially for understanding a property’s appreciation over time. But you have to be careful here, too. Past transactions that happened below market value—like that sale between family members—can create a distorted picture of an asset's history. It’s important to identify and account for those anomalies.

Choosing the Right Valuation Approach

Figuring out fair market value isn't about plugging numbers into a universal formula. It just doesn't work that way. The right method depends entirely on what you're trying to value. If you use the same technique to price a commercial office building as you would to set a software engineer's salary, you're going to end up with a number that's not just wrong, but indefensible.

The trick is to pick the right playbook from the very beginning. Your choice dictates the kind of data you need to hunt down and how you'll analyze it, ensuring the final figure you land on is both accurate and solid. We generally work with three core methods: the Market, Income, and Cost approaches. Each one shines in different situations.

The Market Approach

This is probably the one you're most familiar with—it's intuitive and by far the most common. The core principle is simple: something is worth what people are currently paying for similar things. This makes it the go-to approach for anything with plenty of public transaction data, like a house in a bustling suburb or a common job role like a Digital Marketing Manager.

It's a cornerstone method used across business, real estate, and asset valuation globally. You’re essentially comparing your subject asset to similar ones that have recently sold on the open market. A good rule of thumb, and an industry standard, is to find at least three solid "comps" to average out a reliable FMV. You can see how professionals apply this to complex business valuations to get a sense of its real-world application.

The Income and Cost Approaches

But what happens when good comparable sales data is thin on the ground, or just doesn't exist? That's when you need a different strategy.

The Income Approach is your best bet for assets that are all about generating cash flow. Instead of looking at what similar assets sold for, you focus on the future. You'll estimate the income the asset is likely to produce over its life and then calculate what that future cash is worth today. It's the preferred method for valuing:

- Rental properties

- Toll roads

- Established, cash-generating businesses

Then there's the Cost Approach. This one comes into play for unique assets that have no direct comps and don't produce a predictable income stream. Here, the logic is based on replacement cost. You calculate value by figuring out what it would cost to build or replace the asset from scratch, then subtracting any depreciation. Think of valuing a custom-built factory, a one-of-a-kind piece of machinery, or a public library.

No matter which path you take, the quality of your data is everything. This is where the core principles of recency, relevance, and credibility come in.

This just drives home the point: outdated, irrelevant, or sketchy data will sink your valuation before you even start, regardless of how sophisticated your chosen method is.

To make the choice clearer, here’s a quick breakdown of the three approaches.

Choosing Your Valuation Method

| Approach | Best For | Core Principle | Example Scenario |

|---|---|---|---|

| Market | Common assets with active markets (real estate, public stocks, common job roles). | Value is determined by what similar assets have recently sold for. | Valuing a three-bedroom house by looking at the sale prices of similar homes in the same neighborhood over the last six months. |

| Income | Assets that generate a predictable stream of income (rental properties, businesses). | Value is the present worth of the future income the asset will generate. | Determining the value of a commercial office building based on its net operating income and a market capitalization rate. |

| Cost | Unique or specialized assets with no direct comps (custom machinery, public buildings). | Value is based on the cost to replace or reproduce the asset, less depreciation. | Assessing the value of a custom-built manufacturing plant by calculating construction costs minus wear and tear. |

Each method has its place, and knowing when to use which is a huge part of getting the valuation right.

I'll let you in on a pro tip: the most robust valuations often don't rely on a single approach. We frequently blend methods to get a more complete picture. For example, I might use the Market Approach as my primary driver but run a quick Cost Approach calculation as a sanity check. This creates a much more balanced and defensible final number.

How to Normalize Data and Make Smart Adjustments

Getting your hands on raw market data is really just the first step. The real magic in determining fair market value comes from knowing how to make smart, defensible adjustments to those numbers.

Raw data is never a perfect match for your specific situation. Just averaging a bunch of numbers you found online is a classic mistake that will almost always lead you to the wrong conclusion. This is where you put on your analyst hat and turn generic information into a valuation that actually means something.

For a salary, that means adjusting a national average to fit your city's cost of living. For a house, it's about accounting for the fact that your place has a brand-new roof while the comparable property down the street doesn't. You have to make sure you're comparing apples to apples.

Adjusting for Geographic Differences

Location is almost always the biggest variable, especially when it comes to compensation. A $120,000 salary for a marketing director in San Francisco means something entirely different than that same $120,000 in St. Louis. The paychecks might look the same, but the lifestyles they afford are worlds apart.

To level the playing field, you need to apply a cost-of-living index. Think of this as a multiplier that accounts for how expensive things like housing, gas, and groceries are in one city versus the national average. Using this index lets you translate a national salary figure into its true local equivalent.

A quick example: Let's say a national benchmark for a role is $90,000. But you live in a city with a cost-of-living index of 1.15, making it 15% more expensive than average. The adjusted local fair market value would actually be $103,500 ($90,000 x 1.15). That single adjustment just made your valuation significantly more accurate.

If you really want to nail this, digging into the mechanics of a cost of living adjustment is a must. It's a foundational skill for any serious salary negotiation or compensation plan.

Quantifying Non-Geographic Factors

Once you've sorted out the location, it's time to tackle the other variables. This part is more of an art, requiring you to make informed judgments on how the market values specific attributes. The goal is to put a credible dollar amount on every key difference between what you're valuing and the data points you're using for comparison.

I find it helpful to think of it like a simple ledger—you're just adding or subtracting value based on specific features.

- Experience and Skills: For a job, you might adjust a salary benchmark up by 5-10% if your candidate has a rare certification or a few more years of direct experience than the typical profile in your dataset.

- Company Size and Stage: A massive, stable corporation can usually afford to pay more than a scrappy startup. It's reasonable to apply a downward adjustment of 10-15% when using a benchmark from a Fortune 500 company for a role at a small business.

- Property Condition: In real estate, this is everything. A freshly renovated kitchen could easily add $25,000 to a home's value compared to a similar house with a 20-year-old kitchen. To make the comparison fair, you'd add that value to the comparable's sale price.

The crucial part is to write down every adjustment you make and why you made it. This is what turns your final number from a "gut feeling" into a well-reasoned, data-backed assessment. By methodically normalizing your data, you build a valuation that is not only precise but also incredibly hard to argue with.

Calculating Your FMV Range and Documenting Your Work

Alright, you’ve gathered your data and normalized it. Now comes the moment of truth. But here’s a pro tip: the goal isn’t to land on a single, magical number. That’s a rookie mistake. A single number feels arbitrary and is easy to dismiss.

The real power lies in establishing a defensible range. This shows you’ve done your homework and understand that markets have nuance. For compensation data, this usually means zeroing in on the 25th, 50th (the median), and 75th percentiles. This spectrum paints a far more realistic picture of the market than a simple average ever could.

Establishing Your Fair Market Value Range

Think of this as plotting your data points on a map. The 50th percentile is the solid middle of the market—it's what most people with a standard skill set are making. The 25th percentile represents the lower end, often for someone a bit newer to the role or working in a smaller company. The 75th percentile is the top tier, reserved for seasoned pros with highly sought-after skills.

Let's put this into practice. After you’ve adjusted your data for location, experience, and other factors, you might find the salary range for a Senior SEO Manager shakes out like this:

- 25th Percentile: $115,000

- 50th Percentile (Median): $130,000

- 75th Percentile: $145,000

See how much more powerful this is? Now you’re not just asking for a number; you're having an informed conversation. You can walk into a negotiation and say, "My research shows the market range for this role is between $115,000 and $145,000. Given my deep experience in e-commerce SEO and enterprise-level analytics, I believe my value is in the upper half of that range."

Your documentation is your armor. In any negotiation or audit, a well-documented valuation process is what separates a credible assessment from a mere opinion. It’s your proof that you’ve done the work.

Why You Can’t Skip the Documentation

This is the part everyone wants to skip, and it's also the part that can make or break your case. You have to document every single step, assumption, and data source. Think of it like showing your work on a high-stakes math problem—the final answer is meaningless without the proof.

This documentation is your rationale, your defense. It’s what you’ll rely on when explaining your valuation to a hiring manager, a business partner, or even an auditor. It creates a clear, logical trail from raw data to your final conclusion, which builds trust and makes your numbers incredibly hard to argue with.

What Your Final Summary Should Look Like

You don't need to write a novel. A clean, simple summary report is all it takes to present your findings professionally. The key is to be organized and transparent.

Here's a quick checklist to make sure your summary has everything it needs to be taken seriously. Think of it as your final line of defense.

Sample FMV Documentation Checklist

| Component | Purpose | Example |

|---|---|---|

| Valuation Summary | A brief, top-line overview of your final FMV range and conclusion. | "The fair market value for a Senior Content Strategist in Austin, TX, with 7 years of experience is estimated to be between $105,000 and $125,000." |

| Data Sources | List every source you used to gather market data, including links. | "Data from SalaryGuide, the 2024 Tech Industry Salary Report, and an analysis of public job postings from Q1 2024." |

| Normalization & Adjustments | Detail every adjustment made and the reasoning behind it. | "Applied a +9% cost-of-living adjustment for Austin (vs. national avg). Added a +5% premium for advanced Google Analytics certification." |

| Assumptions | State any key assumptions that influenced your analysis. | "Assumed a company size of 200-500 employees. Assumed the role requires direct management of a small team." |

By systematically calculating a range and then meticulously documenting your process, you do more than just find a number. You create an assessment that is not only accurate but also completely defensible, turning your research into a powerful tool for any important conversation.

Still Have Questions? Let's Clear Things Up

Even with a solid process, figuring out fair market value can sometimes feel more like an art than a science. There are always a few tricky situations and common questions that come up. Let's walk through some of the ones I hear most often.

One of the biggest mix-ups is the difference between an asking price and actual fair market value. It's a simple but crucial distinction. An asking price is just what someone hopes to get for something. FMV, on the other hand, is grounded in reality—it’s based on what similar roles or assets are actually being paid for or sold for. Always, always anchor your analysis in real-world, closed deals, not aspirational listings.

But what happens when you’re trying to value something totally unique, with no direct "comps" to look at? This is common with highly specialized roles or niche assets. When this happens, you have to get a bit more creative and blend different valuation methods. For example, you might look at the cost to build a similar team or asset from scratch (the Cost Approach) and weigh that against the income it could generate (the Income Approach).

How Does Urgency Factor In?

This is a huge one. The official definition of FMV hinges on the idea that neither party is being forced to make a deal. A rushed or forced sale, where someone needs to liquidate an asset now, is not a reflection of fair market value.

Think about it: a forced sale price is almost always going to be lower because the seller has zero leverage. They can't afford to wait for the right offer.

- A Fair Market Value Scenario: A company takes its time to fill a key role, interviewing multiple qualified candidates over several weeks to find the perfect fit at the right price.

- A Forced "Sale" Scenario: A startup loses a critical engineer right before a product launch and has to hire a contractor within 48 hours, agreeing to a sky-high emergency rate.

A core principle here is the "arm's-length transaction." This just means the two parties are independent, unrelated, and acting in their own best interests without any outside pressure. Any deal made between family members, under duress, or with a desperate timeline should be a major red flag and isn't a reliable data point.

Can Fair Market Value Fluctuate Rapidly?

You bet it can. FMV is not a static number; it's a snapshot in time. It can, and often does, change quickly based on what's happening in the market. A sudden economic downturn, a surge in demand for a specific skill, or a new piece of technology can completely reshape the value of a job or asset.

For instance, the moment a new AI tool automates a major part of a specific job, the demand for people with that manual skill could plummet, directly impacting its compensation value. This is exactly why using fresh, recent data—ideally no more than 12 months old—is absolutely essential for getting an accurate read.

Ready to stop guessing and start knowing your true market worth? SalaryGuide combines real-time salary data with AI-powered tools to give you the clarity you need to advance your marketing career. Explore your market value on SalaryGuide today.