what is total compensation package: A clear guide

When you get a job offer, what's the first thing you look at? The salary, right? It's natural. But fixating only on that base number is like judging an iceberg by its tip—you're missing the massive, hidden value just below the surface.

That hidden value is your total compensation package. It’s the full story of what an employer is offering you, combining your base salary with every other financial and non-financial perk that comes with the job. It’s the real monetary value of the role.

Your True Worth Is More Than Just a Salary

While your salary is obviously a huge factor, it's far from the only one. The true value of a job offer often lies in the components that don't show up on your bi-weekly paycheck.

Think about it: performance bonuses, health insurance, retirement contributions, equity, and even professional development funds all add up. Each piece contributes significant financial and lifestyle value that a simple salary figure just can't convey on its own.

The Real Value Beyond Your Paycheck

To truly understand what a company is putting on the table, you have to look at the entire structure. It's a classic mistake to compare two job offers based on salary alone. Doing that could mean you’re accidentally leaving thousands of dollars in benefits and perks behind.

For instance, a role with a slightly lower salary could easily be the better financial decision if it comes with top-tier health coverage, a generous 401(k) match, or more paid time off. Shifting your mindset to total compensation helps you move from just "earning a living" to strategically building a secure future. It shows you how an employer is investing in you as a whole person, not just a line item on a payroll report.

Why It Matters Now More Than Ever

The modern workplace is a different ballgame. Companies are no longer just competing on salary; they're creating intricate and highly valuable offers to attract the best people. The very definition of a competitive salary has expanded to include the entire benefits and rewards structure.

Understanding your total compensation package isn't just about knowing your numbers; it's about recognizing your full value. It empowers you to negotiate effectively, compare offers intelligently, and choose a role that truly supports your financial and personal well-being.

Employers are getting strategic with these packages. With median salary budgets projected to increase by 3.5% to 4.0%, companies are also setting aside an extra 0.5% to 1.0% of payroll for specific market adjustments and promotions. And with nearly 70% of organizations planning pay equity reviews, it's clear that total compensation has become a complex tool for attracting and keeping great employees.

To help you get a clear picture of what this looks like, the table below breaks down the key components that make up a typical total compensation package.

A Quick Look at Your Total Compensation Package

This table summarizes the main categories you'll find in a comprehensive offer, explaining what each includes and why it's a crucial part of the overall value.

| Component Category | What It Includes | Why It Matters |

|---|---|---|

| Base Salary | The fixed, annual amount you earn before any bonuses, benefits, or other additions. | This is the predictable foundation of your income and often the basis for bonus calculations. |

| Variable Pay | Performance bonuses, commissions, profit sharing, and other incentive-based earnings. | It rewards high performance and directly connects your contributions to additional earnings. |

| Equity | Stock options, Restricted Stock Units (RSUs), or employee stock purchase plans (ESPP). | Gives you a stake in the company's success, with the potential for significant long-term growth. |

| Benefits | Health, dental, and vision insurance; life and disability insurance. | These are critical for your health and financial security, saving you thousands in out-of-pocket costs. |

| Retirement Plans | 401(k) or 403(b) plans, especially with an employer match; pension plans. | The employer match is essentially free money that compounds over time to build your retirement nest egg. |

| Paid Time Off | Vacation days, sick leave, personal days, and paid holidays. | This directly impacts your work-life balance and mental well-being, providing paid rest and recovery. |

| Perks & Other | Professional development funds, wellness stipends, remote work subsidies, commuter benefits. | These non-traditional benefits enhance your quality of life and support your personal and career growth. |

Each of these components adds a tangible dollar value to your employment. By understanding how they all fit together, you can accurately assess any job offer and make the best decision for your career and your wallet.

Deconstructing Your Offer, from Base Pay to Hidden Perks

You’ve got the offer letter in hand. Now what? The first step to understanding your true worth is knowing what a total compensation package actually is. The next, and most important, is breaking it down piece by piece to see how each part contributes to your financial and personal well-being.

Think of it like looking under the hood of a car. The sticker price is one thing, but the engine performance, safety features, and warranty are what really determine its long-term value. Let's peel back the layers of a typical job offer, starting with the obvious and digging into the valuable, often-overlooked benefits that separate a good offer from a great one.

Base Salary: The Foundation of Your Earnings

Your base salary is the number everyone focuses on, and for good reason. It’s the fixed, predictable amount you earn each year, paid out on a regular schedule. This figure is the bedrock of your financial life—it dictates your budget, influences your ability to get a mortgage, and provides a sense of stability.

But its importance goes deeper. Your base salary is often the launching pad for other parts of your compensation. Think annual bonuses (e.g., a 10% bonus on a $90,000 salary) or retirement contributions. It's the anchor of your entire package.

Variable Pay: The Reward for Performance

Next up is variable pay. This is any money that’s tied directly to performance—yours, your team’s, or the company’s as a whole. This is where your individual contributions can translate into a significant financial upside beyond your guaranteed salary.

Common forms of variable pay you’ll see are:

- Annual Bonuses: A lump-sum payment awarded for hitting specific goals throughout the year.

- Commissions: A percentage of the revenue you generate, common in sales and business development.

- Profit Sharing: A plan that gives you a slice of the company's profits, tying your success directly to the business’s bottom line.

This component adds an exciting "what if" element to your earnings, directly linking your hard work to your bank account.

Equity: The Investment in Your Future

Equity compensation is a powerful way for a company to give you a real stake in its long-term success. You’re not just an employee; you’re an owner. It’s especially common in startups and tech, but more and more companies across all industries are using it to attract and retain top talent.

Equity can come in a few different flavors:

- Stock Options: The right to buy company stock at a predetermined price down the road.

- Restricted Stock Units (RSUs): Shares of company stock that are granted to you once you meet certain conditions, like staying with the company for a set period (known as vesting).

While its value isn’t guaranteed—it depends entirely on how the company performs—equity holds the potential for massive growth. It can turn your hard work into a truly valuable long-term asset.

Health and Wellness Benefits: The Shield for Your Security

This is where the hidden value really starts to add up. Employer-sponsored health and wellness benefits are a cornerstone of any solid compensation package, protecting you from potentially crippling out-of-pocket expenses. These aren’t just nice-to-haves; they are essential for your financial security.

A great benefits package is more than a safety net; it’s a significant, non-taxable part of your income. The thousands of dollars an employer puts toward your health premiums are dollars you don't have to earn and pay taxes on first.

These benefits usually cover:

- Medical, Dental, and Vision Insurance: For everything from routine check-ups to major procedures.

- Life and Disability Insurance: A financial cushion for you and your family if the unexpected happens.

- Mental Health Support: Access to counseling and employee assistance programs (EAPs).

When a company heavily subsidizes these benefits, they're making a huge investment in your well-being that adds thousands of dollars in real value to your offer.

Retirement Plans: The Engine for Your Future

An employer-sponsored retirement plan, like a 401(k), is one of the most effective wealth-building tools you'll ever have. The most critical piece of this benefit? The employer match.

For example, if your company offers a 100% match on contributions up to 6% of your $100,000 salary, they are literally giving you an extra $6,000 per year just for saving for your own future. It’s free money that grows over time thanks to the magic of compound interest. Ignoring this is like turning down a guaranteed raise, year after year.

Paid Time Off: The Currency of Work-Life Balance

Paid time off (PTO) has both a clear monetary value and an invaluable impact on your life. Every day you're paid while on vacation, sick, or taking a personal day is a direct contribution to your overall compensation.

A generous PTO policy is a company’s best defense against employee burnout. When comparing offers, look at the total number of vacation days, sick days, and paid holidays. An extra week of vacation could be worth thousands of dollars, not to mention its importance in maintaining a healthy work-life balance.

Perks: The Lifestyle Enhancers

Finally, we get to the perks. These are the non-traditional benefits that make your day-to-day life better and support your growth. They might seem small on their own, but their combined value can be surprisingly high.

These can include things like:

- Professional Development Stipends: Money for courses, conferences, or certifications.

- Wellness Subsidies: Funds for a gym membership or fitness apps.

- Remote Work or Commuter Benefits: An allowance for your home office setup or transportation costs.

Each one of these components plays a vital role in your total package. By looking past the salary and examining every single piece, you can finally see the full picture of what a company is truly offering you.

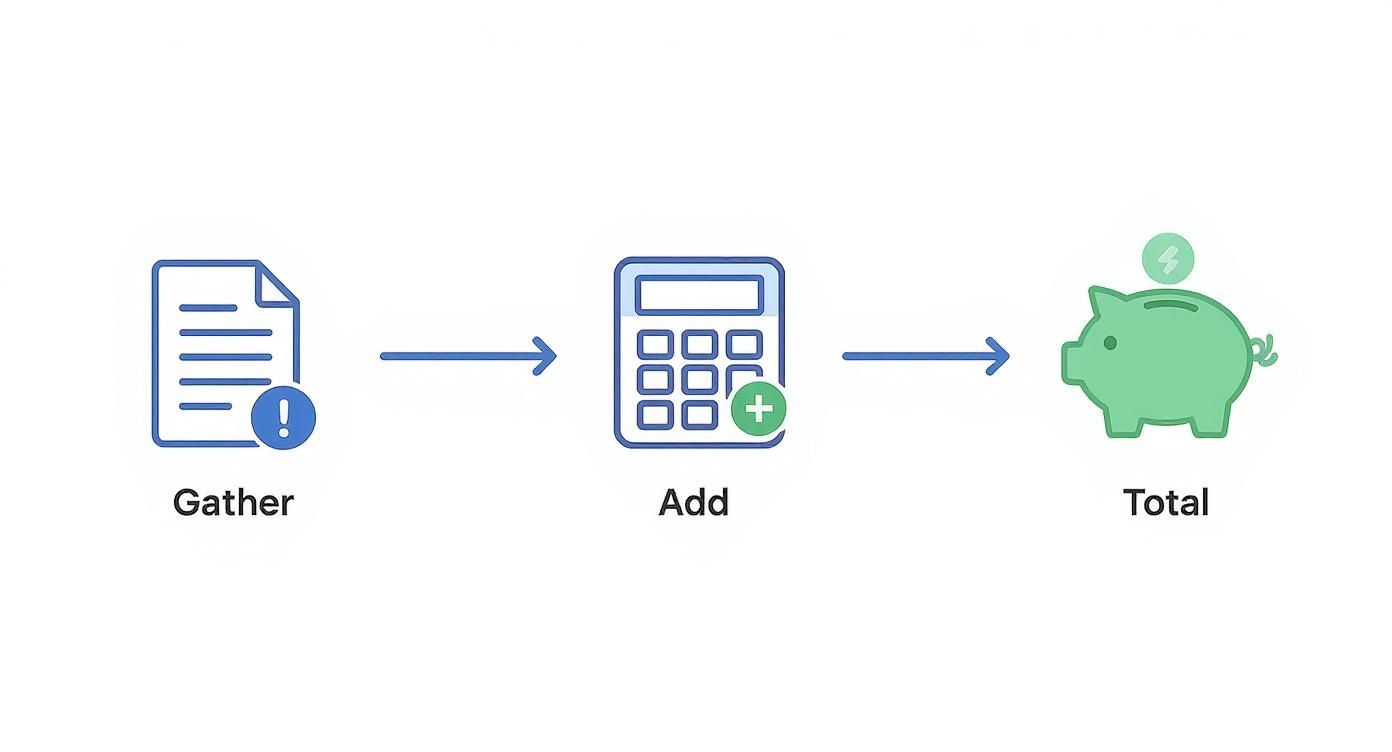

How to Calculate the Real Value of Your Offer

Looking at a job offer can feel like trying to compare apples and oranges. One company offers a higher salary, but another has an amazing 401(k) match and covers all your health insurance premiums. How do you figure out which one is actually better?

The secret is to calculate your total compensation. This just means putting a dollar value on every single piece of the offer, from the obvious stuff like your salary to the perks like a gym stipend. It’s the only way to get a true, side-by-side comparison.

The Core Formula for Your Calculation

Thinking about total compensation isn't complicated. It boils down to a simple idea: adding up all the different ways a company pays you.

Total Compensation = Base Salary + Variable Pay + Equity Value + Benefits Value + Perks Value

This little formula is your best friend when comparing offers. It forces you to look beyond the salary number—which is often just the tip of the iceberg—and see the full financial picture.

Let’s make this real. We'll walk through a typical offer for a Marketing Manager and assign some hard numbers to see how it all adds up.

Step-by-Step Calculation for a Marketing Manager

Imagine you just got an offer for a new Marketing Manager role. Here’s how you'd break it down, line by line, to find its true annual worth.

1. Start with the Cash: Base Salary and Bonus

First things first, let's tally up the money that will actually hit your bank account. This part is the most straightforward.

- Base Salary: The company is offering you $95,000.

- Target Bonus: There’s a performance bonus with a target of 10% of your base pay. If you hit your goals, that’s another $9,500 ($95,000 x 0.10).

Right off the bat, your direct cash compensation is $104,500. But we’re just getting started.

2. Quantify the Value of Your Benefits

This is where a huge chunk of "hidden" value often lies. These are expenses you'd otherwise have to cover yourself.

- Health Insurance: The company pays $12,000 a year for your medical, dental, and vision coverage. That's $12,000 that isn't coming out of your pocket.

- Retirement Match: They offer a 100% match on your 401(k) contributions up to 5% of your salary. For a $95,000 salary, that's an extra $4,750 they're putting into your retirement fund each year. It’s literally free money.

Just these two benefits add a whopping $16,750 to your package.

3. Add Up the Perks and Allowances

Don’t dismiss the smaller things. These stipends and allowances are real money that directly impacts your budget.

- Professional Development Fund: They give you $2,000 a year for courses, conferences, or certifications to help you grow.

- Wellness Stipend: You get $600 annually to put toward a gym membership or other wellness activities.

- Commuter Subsidy: They also provide $1,200 a year ($100 per month) to help with your commute.

These perks tack on another $3,800 in real, tangible value.

4. The Final Tally

Okay, let's put it all together.

Sample Total Compensation Calculation for a Marketing Manager

This table gives you a clear, at-a-glance view of how every component builds up to the final number. It’s a powerful way to visualize the complete offer.

| Compensation Component | Example Value | Annual Monetary Value |

|---|---|---|

| Base Salary | N/A | $95,000 |

| Target Annual Bonus | 10% of base salary | $9,500 |

| Health Insurance Contribution | Employer's annual premium cost | $12,000 |

| 401(k) Employer Match | 5% match on base salary | $4,750 |

| Professional Development Fund | Annual allowance | $2,000 |

| Wellness Stipend | Annual allowance | $600 |

| Commuter Subsidy | $100 per month | $1,200 |

| Total Annual Compensation | Sum of all components | $125,550 |

And just like that, the $95,000 salary offer is actually a $125,550 total compensation package.

That’s over $30,000 in extra value that you might have overlooked if you only focused on the base salary. Running these numbers completely changes your perspective and gives you the hard data you need to make the smartest possible career decision.

Comparing Job Offers: A Tale of Two Packages

So, you've learned how to put a real dollar value on every component of a job offer. Now, let's put that knowledge into practice. This is where things get interesting, because comparing offers is rarely an apples-to-apples situation.

You might have one offer with a huge salary that makes your eyes pop and another with benefits that seem too good to be true. It's a classic dilemma, and it’s where a lot of people trip up—getting so fixated on that big base number that they overlook a package that’s actually worth much more.

Let's walk through a scenario I see all the time. Imagine you're a marketer with two competing offers. Offer A is from a big-name tech giant, while Offer B comes from a scrappy, fast-growing startup. At first glance, the choice seems like a no-brainer.

But is it? Let's dig in.

Offer A: The High-Salary Temptation

Company A slides an offer across the table with a base salary that immediately grabs your attention. It’s a major leap from what you’re making now and feels like an obvious win.

Here’s the breakdown:

- Base Salary: $115,000

- Annual Bonus: A target of 5% ($5,750)

- Healthcare: A high-deductible plan that will cost you $400 a month ($4,800 per year) out of pocket.

- 401(k) Match: A 50% match on the first 6% of your salary (so, they’ll contribute a maximum of $3,450).

That salary number is impressive, no doubt. But the benefits are just okay. This is a common play—dangle a big salary to get you in the door while keeping their own costs on benefits relatively low.

Offer B: The Hidden Gem

Company B’s offer comes in with a lower salary, and you might feel a little disappointed at first. But when you start to really look at the whole package, a completely different story emerges.

Here’s what they’re offering:

- Base Salary: $105,000

- Annual Bonus: A much more generous 10% target ($10,500)

- Healthcare: A premium plan with 100% of your premium covered by them (a $0 cost to you).

- 401(k) Match: A full 100% match on the first 6% of your salary (meaning they’ll kick in up to $6,300).

Sure, the salary is $10,000 less than Offer A, but that stronger bonus and killer benefits package suggest there’s more value hiding under the surface. Let’s do the math and see which offer truly comes out ahead.

This visual guide breaks down the simple steps to calculate and compare your offers.

By lining up all the numbers, you get a clear financial picture that goes way beyond that initial salary figure.

By lining up all the numbers, you get a clear financial picture that goes way beyond that initial salary figure.

The Head-to-Head Showdown

Let's run the numbers and calculate the real annual value of each offer. Remember, we need to subtract your personal costs, like that hefty healthcare premium in Offer A.

| Component | Offer A (High Salary) | Offer B (Better Benefits) |

|---|---|---|

| Base Salary | $115,000 | $105,000 |

| Target Bonus | + $5,750 | + $10,500 |

| Healthcare Value | - $4,800 (Your Cost) | + $0 (Your Cost) |

| 401(k) Match Value | + $3,450 | + $6,300 |

| Total Annual Value | $119,400 | $121,800 |

And just like that, the tables have turned. Offer B, despite its lower salary, is actually worth nearly $2,400 more per year. This is a perfect example of why you have to look at the entire compensation picture.

This isn't just a hypothetical, either. Recent data from the U.S. Bureau of Labor Statistics shows that while private industry wages rose by 4.1%, the cost of benefits jumped by 3.5%. Benefits are a huge—and growing—part of your financial reality.

At the end of the day, this isn't just a math problem. It’s about matching your career move to your life priorities. If you’re young, healthy, and rarely see a doctor, maybe Offer A still looks good. But if you have a family or want to get serious about retirement savings, Offer B provides far greater long-term security. Understanding the average salary increase when changing jobs is a great start, but true financial growth comes from knowing the value of the entire package.

How to Negotiate Your Full Value Beyond Salary

https://www.youtube.com/embed/J30wmYgzVXM

Once you’ve done the math and calculated the full value of a job offer, it's time to talk. Far too many people get fixated on the base salary, and when they hear, "Sorry, that’s the top of our range," they give up. That isn't the end of the negotiation—it's the beginning of a smarter one.

The key is knowing when to pivot. A company's salary bands are often pretty rigid. They're locked in by internal pay equity policies and strict budgets that a hiring manager just can't override. But other parts of the total compensation package? That's where you'll find a lot more wiggle room.

Think about it from the company’s perspective. An extra $5,000 in base salary is a cost that repeats and grows every single year. A one-time $5,000 signing bonus, on the other hand, is a single hit to the budget that’s much easier for the finance department to approve.

Broaden Your Negotiation Strategy

Don't get tunnel vision on that one salary number. If the base pay conversation hits a wall, confidently shift the discussion to other areas of the offer. This does more than just get you more value; it shows you're a creative problem-solver who sees the bigger picture.

Here are a few components that are almost always more flexible than base pay:

- Signing Bonus: This is your easiest and most effective pivot. If they can’t bump the salary, ask for a one-time bonus to make up the difference in your first year's income.

- Performance Bonus: You can negotiate for a higher target percentage. Or, even better, ask for a guaranteed minimum bonus for your first year while you're getting up to speed.

- Professional Development: Request a larger annual stipend for certifications, courses, or industry conferences. Frame it as an investment in skills that you'll bring right back to the company.

- More Paid Time Off: An extra week of vacation is a huge lifestyle improvement and often costs the employer very little directly.

"If we can’t quite get to my target base salary, I'd be happy to explore other options. Would you be open to a one-time signing bonus of $7,500 to help close that gap?"

This simple question completely reframes the conversation. You’ve moved it from a standoff to a collaborative search for a win-win solution, all while staying positive and signaling your willingness to be flexible.

Understand the Recruiter's Toolkit

Your secret weapon is knowing what a recruiter can and can't actually change. Salary ranges are usually set in stone by a central compensation team. Recruiters, however, often have discretionary power over other perks.

For instance, they can often get much faster approval for a signing bonus or a relocation package. Company-wide benefits like the health insurance plan are almost never negotiable for one person. But individual perks, like a home office stipend or a more flexible work schedule, are often up for discussion. For a more detailed look at the negotiation dance, check out our guide on how to counter a job offer.

Back Your Ask with Data

Your arguments are always more powerful when you back them up with solid research. The current hiring market has a real disconnect between what companies are budgeting and what employees are experiencing. Recent data shows a staggering 53% of employees saw no pay increase last year. And of those who did, 47% received raises that didn't even keep up with inflation.

This context is important. It shows that rigid salary budgets aren't meeting the mark, which makes a strong case for finding flexibility elsewhere in the offer. By understanding what a total compensation package is, you elevate the conversation far beyond a simple salary haggle. You learn to advocate for your complete value, landing a role that doesn't just pay well but truly invests in your growth, well-being, and future.

Frequently Asked Questions About Compensation

Diving into the details of a job offer can feel a bit like reading the fine print. Even when you grasp the big picture of total compensation, things like equity or company perks can feel vague. Let's clear up some of the most common questions that pop up when you're weighing your options.

Getting straight answers is the last step to feeling truly confident in your choice. Here are some straightforward explanations to help you understand the nuances and pick the best path for your career.

How Do I Figure Out What Company Equity Is Actually Worth?

Company equity, whether it’s stock options or Restricted Stock Units (RSUs), often feels like holding a lottery ticket. It’s exciting, for sure, but its real value is anyone’s guess. Unlike a salary, its worth isn't set in stone and hinges entirely on how well the company does in the future.

The most important concept to wrap your head around here is vesting. You don't get all your shares on day one. Instead, they’re handed out over a set period to encourage you to stick around. A classic vesting schedule is four years with a one-year "cliff"—meaning you get nothing until you hit your first anniversary, then you get 25%. The rest usually vests monthly or quarterly after that.

To get a ballpark figure of its potential value, you can multiply the number of shares by the current stock price (if it’s a public company) or the price from the latest funding round (if it’s private). But always, always treat this number as a speculative bonus, not cash in the bank.

The Bottom Line: Think of equity as a high-risk, high-reward incentive. Its value is tied directly to the company's performance, and you won't see a dime until you can sell your vested shares, which could be years away.

Are Perks Like a Gym Membership Really Part of My Pay?

Yes, absolutely—though their value is often more personal than purely financial. Perks are the non-traditional benefits that make your life better. While a gym membership or a remote work stipend might not show up in your paycheck, they represent real money you're not spending out of your own pocket.

It helps to think about perks in two buckets:

- Taxable Benefits: Some perks, like a cash bonus for wellness, are treated as taxable income.

- Non-Taxable Benefits: Many others, like an employer paying a gym directly for corporate memberships, are often non-taxable fringe benefits.

The best way to evaluate them is to assign a personal "lifestyle value." If a company offers a $1,200 annual wellness stipend and you already spend that much on fitness, that perk is worth its full cash value to you. These benefits are a direct boost to your quality of life, cutting your personal expenses and supporting a healthier balance.

Can I Actually Negotiate My Benefits Package?

That’s a great question, and the answer isn't a simple yes or no. While some core benefits are locked in, others have a surprising amount of wiggle room. Knowing the difference is what separates a good negotiator from a great one.

Certain benefits are standardized across the company and can’t be tweaked for one person. These usually include:

- Health, Dental, and Vision Insurance: The plans and premium costs are set for the entire employee group.

- 401(k) Matching Programs: The matching formula is part of a formal plan document and has to be applied equally to everyone.

But don't let that stop you. Many other valuable parts of your offer are often on the table, especially if the company won’t budge on base salary.

You can often successfully negotiate for things like:

- More Paid Time Off: Asking for an extra week of vacation is a common—and often successful—request.

- A Professional Development Budget: You can push for a higher annual allowance for courses or conferences that will make you better at your job.

- Flexible Work Arrangements: Negotiating for a hybrid schedule or specific remote days can add massive value to your work-life balance.

- A Signing Bonus: If the salary is maxed out, a signing bonus is the perfect way to close the gap in your first-year earnings.

The key is to frame your requests as an investment in your productivity and long-term success with the company. By focusing on these flexible areas, you can seriously boost the total value of your offer without hitting a wall on a fixed salary number.

Ready to see what your skills are really worth? SalaryGuide provides the real-world salary data, transparent job listings, and expert advice you need to benchmark your value and negotiate with confidence. Explore our tools and find your next role today.